Notarial Certificate on Loan Documents: Tips for the Notary Signing Agent

Table of Contents

What is a loan package?

A loan package is a collection of documents and instructions used when taking out a loan. It usually includes the loan application, promissory note, credit report, title search, deed of trust or mortgage, truth-in-lending disclosure statement, and other necessary documents.

The notary signing agent’s job is to verify the identity of the loan signer, witness their signature on the loan documents, and certify that the population was done correctly. Here are some tips for notarizing loan documents:

- Ensure that all parties involved in the transaction have valid identification and appear in person before you.

- Review each document to ensure it is filled out and has all the necessary signatures.

- Ask questions if anything is unclear and explain the documents in simple language to ensure that all parties understand what they are signing.

- Notarize only the signatures on the documents, not their contents.

- Be mindful of deadlines and keep accurate records of each loan transaction you complete.

What is a notarial certificate?

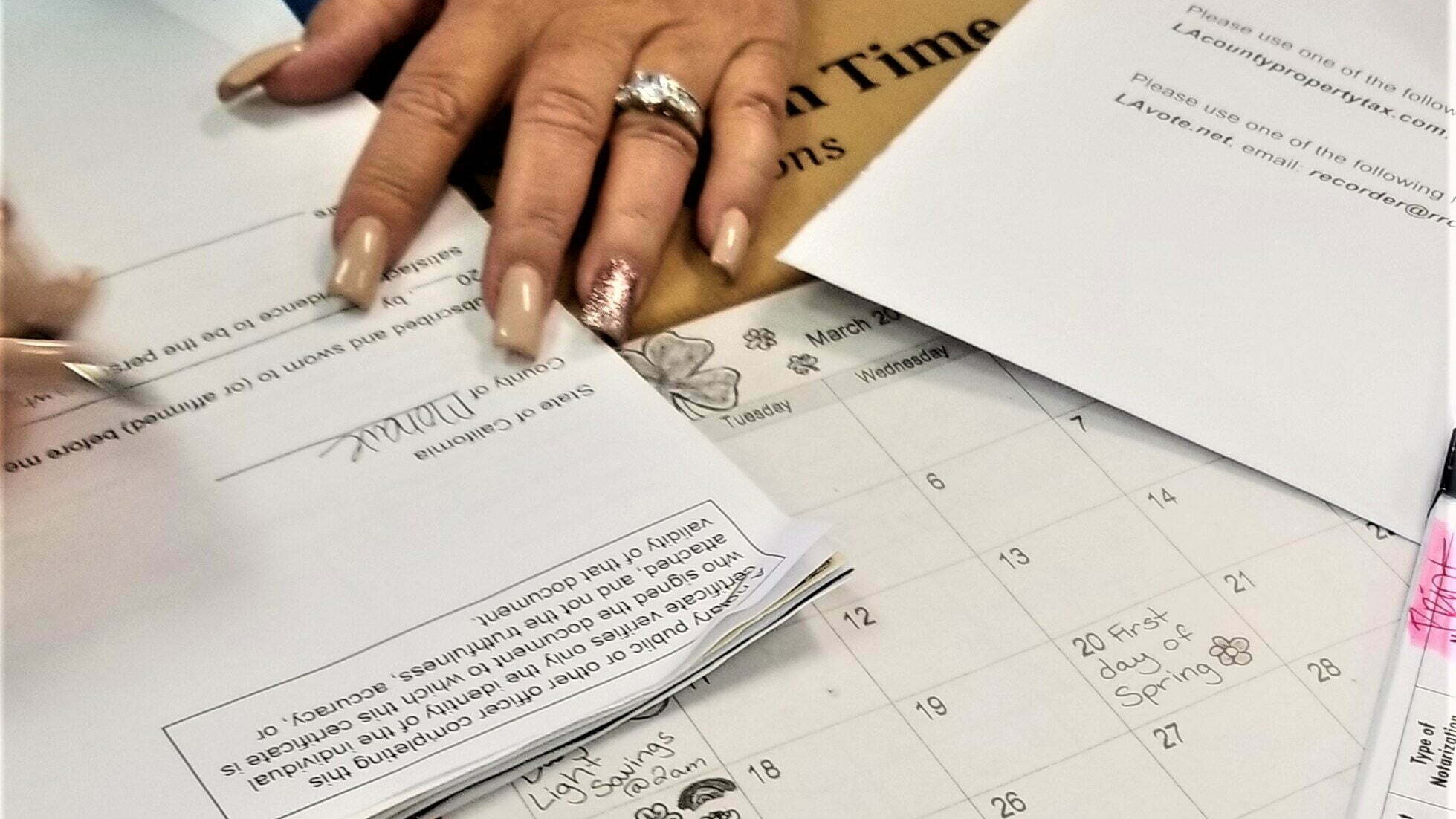

A notarial certificate is a record of the notary’s act and includes information such as: who was present, what documents were signed when the signing occurred, and any other details relevant to the transaction. The notarial certificate must be completed accurately, completely, and legibly to ensure the validity of the document. Each state has different laws regarding how a notary public completes a notarial certificate and records it in the notary journal.

Which type of notarization is typically required for mortgage documents in a loan signing?

Acknowledgments and jurats are the most common notarizations in a mortgage loan. Different states might have slightly different definitions, but these are good starting points.

An acknowledgment is a statement in front of the notary by the signer that they willingly signed the document.

A jurat is a statement under oath made by the signer in front of the notary that declares that all information included in a document is true and correct to their knowledge. It’s typically an oath or affirmation that is similar to an affidavit.

What should loan signing agents do if they don’t know which notarization to perform?

Notary Signing Agents signing loan documents must be familiar with state laws to know how to perform these notarizations to ensure that the notarial certificate is used. However, the notary can’t choose which type of notarial certificate to use or give any legal advice. There are many documents in a loan package, and the signing agents need to become familiar with the most common ones. If it’s unclear which to use, the borrower or loan signing agent should contact the closing agent, title company, or other contracting company to request guidance on the correct type of notarization for all the title documents and other documents in the loan signing.

What common documents require notarization?

Not all documents in a loan signing require notarization. It is the notary’s responsibility to ensure that the proper notarizations are conducted during loan signings.

Deed of Trust / Mortgage

Different states call this document either a Deed of Trust or a Mortgage. These have the same purpose: “attaching” the loan to the collateral property as a security instrument. This document means the property can be taken away if the borrower does not repay the loan.

Affidavit of Debts and Liens

The signer declares any liens they have on the property related to the loan in this document.

Affidavit of Occupancy

An occupancy affidavit states that the borrower intends to occupy the property as a primary residence.

Borrower’s Closing Affidavit

In the document, the borrower promises that they have not done anything to damage the title of their property, for example, by declaring bankruptcy or getting divorced.

Certificate of Trust

This document certifies that information regarding any trusts related to the transaction is correct.

Disbursement of Proceeds

This document declares how any proceeds from real estate transactions should be disbursed.

Errors & Omissions (E&O) and Compliance Agreement

This means that if the lender needs help to fix any mistakes in the papers after the loan is closed, the borrower will help. This only applies to minor mistakes in the paperwork.

General Warranty Deed

A general warranty deed is a real estate deed that guarantees the title to a property is transferred without any encumbrances or restrictions.

Grant Deed

A grant deed is a legal document used in real estate transactions that states that the grantor (seller) of property transfers ownership to the grantee (buyer). The deed indicates the terms and conditions of the transfer, such as any mortgages or liens, that must be satisfied before ownership can be transferred. It also typically includes a description of the transferred property, a legal description, and any taxes or fees that must be paid.

Homestead Affidavit

A homestead affidavit is a document in which a person declares that a particular property is their principal residence.

Limited Power of Attorney / Correction Agreement

This agreement enables the lender to fix any clerical errors, but it does not enable anyone to change the terms of the loan.

Marital Status Affidavit

This document requires the signer(s) to confirm their marital history.

Name Affidavit / Signature Affidavit/ AKA Statement

Many people have different names, for example, a woman’s name before marriage or an immigrant’s name that has been legally changed. This document will list all names known to the lender and require the signer to either sign or put their initials next to each one.

Owner’s Affidavit

An owner’s affidavit is a document in which the owner of a property swears or affirms the truthfulness of its contents.

Quitclaim Deed

A Quitclaim Deed is a document used to transfer ownership of real property from one individual or entity to another.

Refinance Affidavit

In this document, the people who are getting the loan agree to the information written about the property.

Subordination Agreement

This document changes the priority of existing liens against the property, for example, an existing HELOC or second mortgage, ensuring that the new Deed of Trust/Mortgage will be in the first position on the title of the property.

Survey Affidavit

This document has information about the property survey.

Tax Affidavit

This document will explain the property taxes.

What loan documents DO NOT typically require notarization by the mobile notary public?

There are many, but some common loan documents that don’t require a notarial certificate are listed below.

Settlement Statement

This statement outlines the charges for taking out a loan, and all fees will be explained in detail. It includes the interest rate and other costs for the transaction. It shows how much money the borrower will get (for cash-out transactions) or how much they need to pay to close.

First Payment Letter

The document says when the borrower’s first payment is due and how much it will be. It’s included in every loan package so that each new borrower knows exactly how to make their first monthly payment.

Impound Account Letter

An Escrow, or Impound Account, is a special escrow account that the lender sets up to pay for property taxes and homeowner’s insurance for the borrower.

Notice of Right to Cancel

The Notice of Right to Cancel (RTC) will be included if the signed loan allows the borrower to cancel within three business days. All of the borrowers will receive copies.

Responses